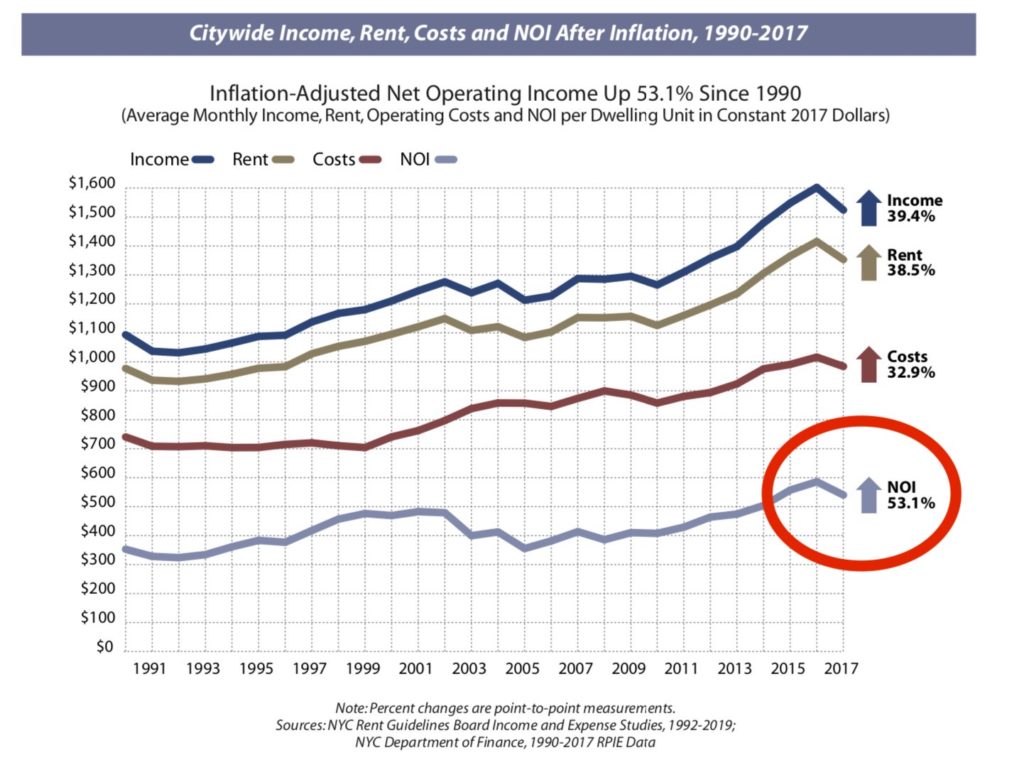

Rent Guidelines Board issues conflicting NOI data for regulated apartments

Rent Guidelines Board's cross-sectional analysis of NOI showing a 5 percent decline (red circle added)

One analysis said NOI rose by 0.4%; another showed NOI declined by 5%

By Adam Pincus

The Rent Guidel