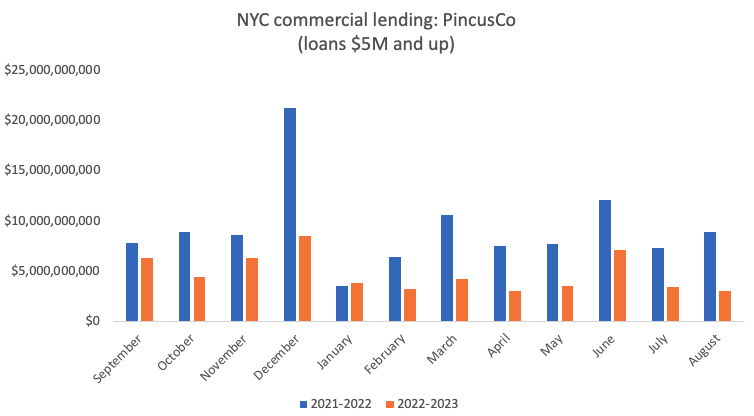

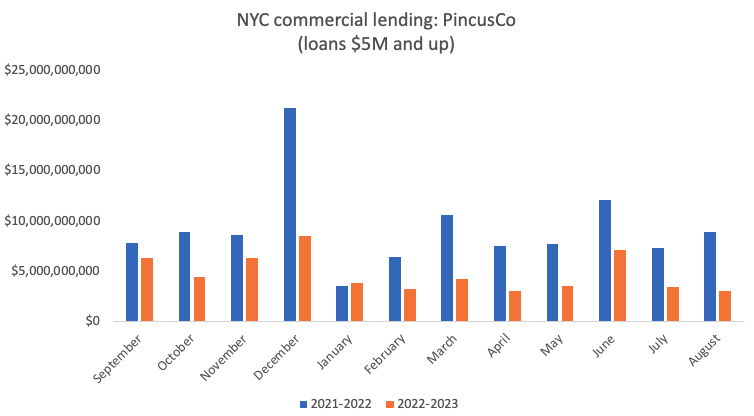

NYC commercial lending falls 49% over past 12 months

NYC commercial lending 12-month yoy PincusCo

New York City commercial lending fell nearly 50 percent over the past 12 months that ended August 31

NYC commercial lending 12-month yoy PincusCo