Fortress declares $533.5M loan to Cohen Brothers NYC, Fla., entities in default, demands full payment

135 East 57th Street (Credit - Google)

Lender Fortress Investment Group through its affiliate Fortress Credit Corp., alleges the Forbes-designated billionaire Charles S. Cohen of Cohen Brothers Realty is in a payment default on a 2022 loan with an original principal of $533.6 million, and the lender declared the entire amount due immediately, according to court records filed yesterday.

Fortress accelerated the loan, alleging Cohen’s entities now owe a total of $544.3 million in principal and interest. Fortress filed the action in New York State Supreme Court in Manhattan on March 25, 2024.

Case LINK

This court action is a motion for summary judgment in lieu of complaint, Fortress is not suing to foreclose on the loan. Court filings represent the position of one party and are not necessarily accurate or complete.

Cohen Brothers Realty owns a large portfolio of office buildings in New York City, Florida and elsewhere, including Tower 57, Grand Central Plaza and 3 Park Avenue.

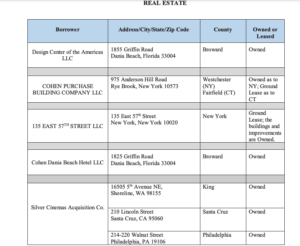

The loan is secured by real estate such as the office building at 135 East 57th Street (Tower 57), the Design Center of the Americas in Miami, a development in Westchester County‘s Rye Brook, as well as assets related to Cohen’s film ventures Landmark and Curzon.

Fortress gave the loan with a maximum principal of $533.64 million in September 2022. The Real Deal reported in August 2023 that the loans were declared delinquent.

The loan document caps the guaranty Cohen allegedly signed to $187 million, according to the court documents.

The filing is seeking summary judgment in lieu of complaint, according to the affirmation of David Moson, Fortress managing director and head of real estate lending asset management, according to his LinkedIn profile.

According to the filing, “Borrowers failure to pay… the Deferred Amortization Payment in the amount of $5,256,679.71, due on February 1, 2024… PIK [Pay-In-Kind] Interest in the amount of $13,914,106.24, due on February 1, 2024… scheduled payment of interest on the Loan in the amount of $4,910,002.16… due on February 15, 2024…

“By letter sent to the Borrowers and Guarantor, dated March 11, 2024… Agent notified the Borrowers and Guarantor that Events of Default have occurred… in the same March 19 Letter, the Agent declared as a result of the ongoing Specified Events of Default, Agent hereby declares the Guaranteed Obligations (as defined in the Payment Guaranty and in the Carry Guaranty) to be immediately due and payable by Personal Guarantor…”

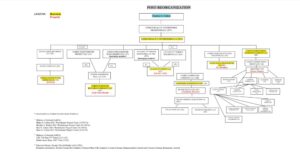

The total principal allegedly due is $515.7 million and the unpaid interest is $28.6 million for a total due of $544.3 million, according to the filing. The loan is secured by Charles Cohen’s interest in seven real estate and film entities, with one of them being 135 East 57th Street, an office building Cohen owns through a ground lease. The landlords on the ground lease are, the loan agreement says, “William F. Wallace and Stratford C. Wallace, in their capacity as trustees under that certain trust agreement, dated June 2, 1969 between Dolorita Fitzgerald Wallace, as settlor, and said trustees,” through a lease dated December 19, 1972.

Direct link to the property’s ACRIS page and link to DOB NOW portal.