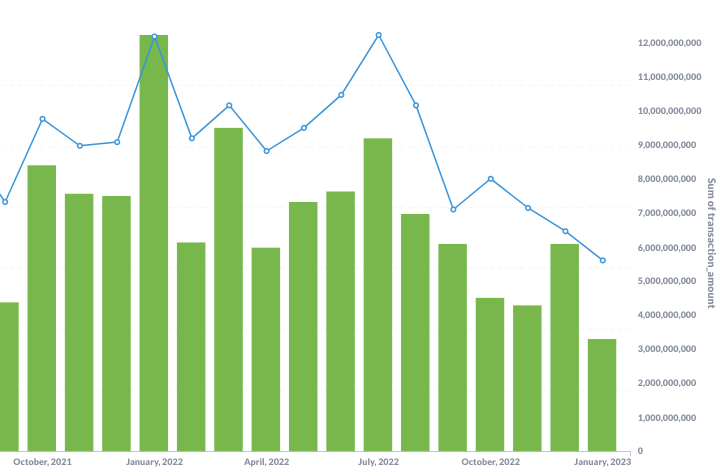

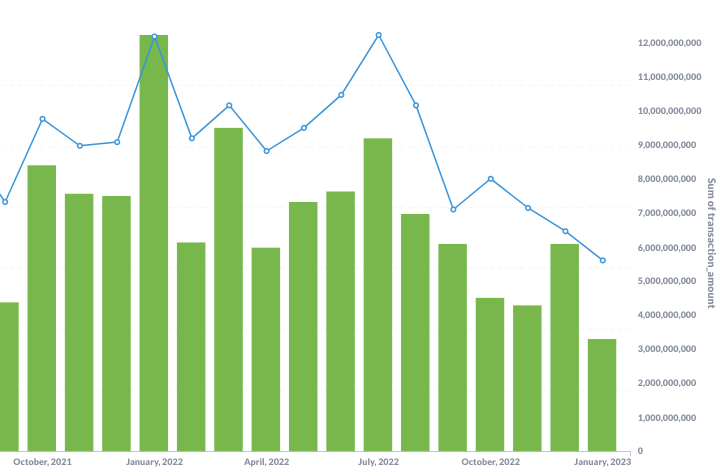

NYC construction lending boosts flagging CRE finance market: Analysis

Lending declined last month in NYC

New York City commercial real estate lending fell last month to $5.3 billion, down 34 percent from t

Lending declined last month in NYC