Mid-sized multifamily sales seize up, but smaller rental buildings remain active: Analysis

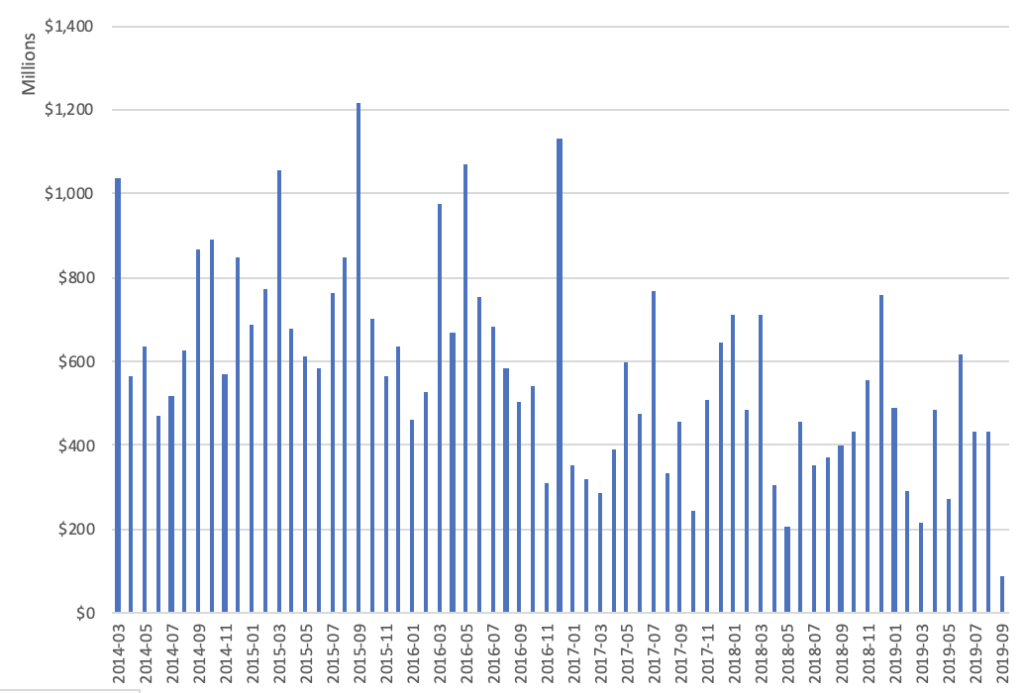

Monthly mid-sized multifamily sales fell to $88 million in September

By Adam Pincus

The impact of the June rent-regulation laws on the city’s sales market has been swi