Gotham, Monadnock, church, sign $217.4M construction loan for 386 units in East New York

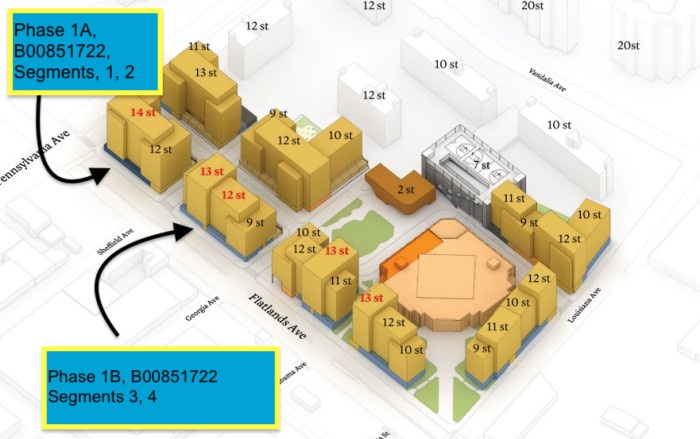

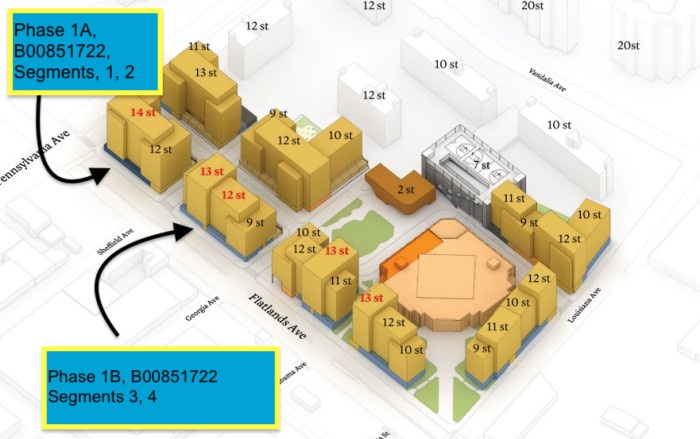

Urban Village development site in East New York

Gotham Organization, Christian Cultural Center, and Monadnock Development through the entity IUV Pha

Urban Village development site in East New York