Georgica Green pays $10.4M to Safehold for Coney Island dev site, gets $165M building loan

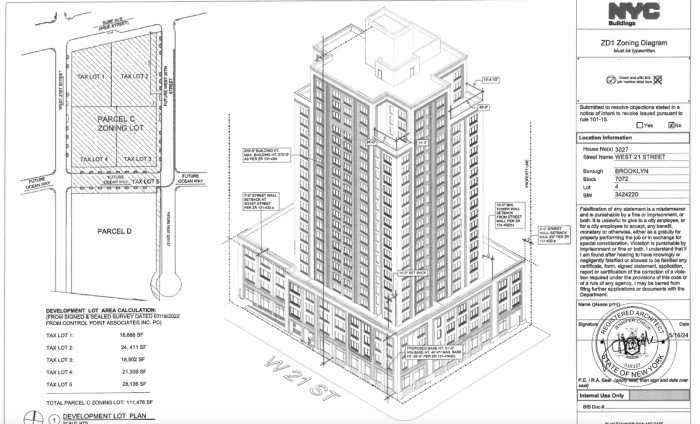

3027 West 21st Street (Credit - Jennifer Cheuk architect via DOB)

Georgica Green Ventures and its nonprofit partner RiseBoro Community Partnership through the entity