Clipper Equity signs $95M construction loan with Bank Hapoalim for 130-unit project in Flatbush

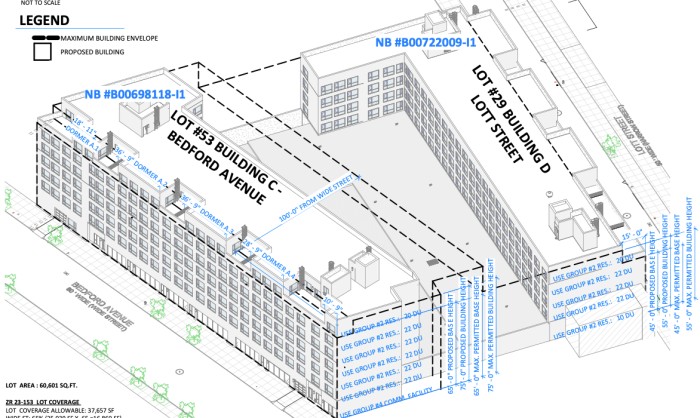

2359 Bedford Avenue axonometric rendering (Credit - Shmuel Wieder architect)

Clipper Equity through the entity Bedford Beverly 2359 LLC as borrower signed a new construction loa