Clipper Equity signs $105M construction loan in Flatbush

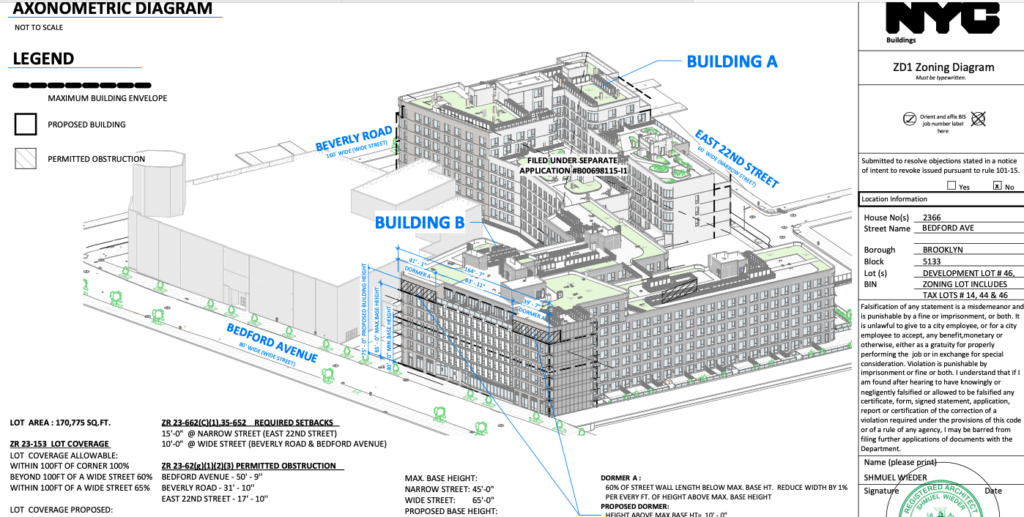

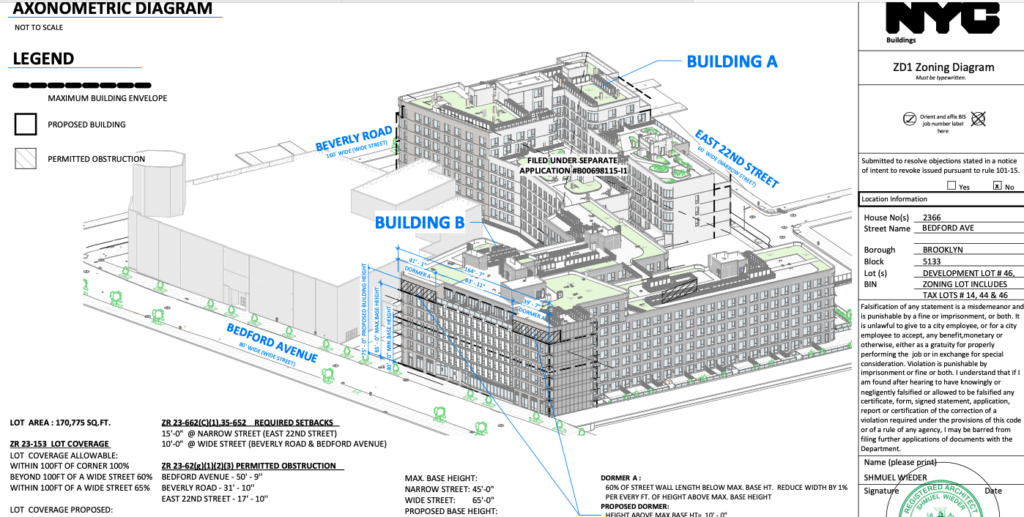

Building A at 2201 Beverly Road (Credit - Shmuel Wieder)

Clipper Equity through the entity Bedford Beverly A LLC as borrower signed a new construction loan w

Building A at 2201 Beverly Road (Credit - Shmuel Wieder)