Cayre Equities signs $25.5M refi loan with TD Bank for industrial in Harlem

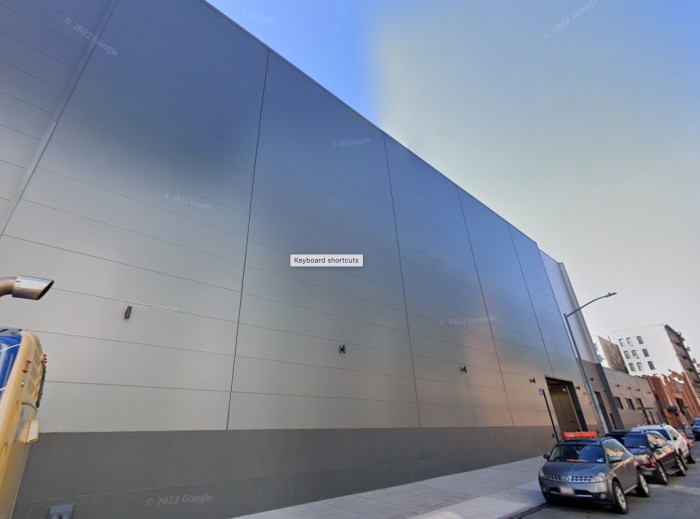

122 West 146th Street (Credit - Google)

Cayre Equities through the entity CS 122 West 146th Street LLC as borrower signed a refi loan with l

122 West 146th Street (Credit - Google)