$1B-plus in take-out financing likely for Tishman, Rockrose, in LIC this year

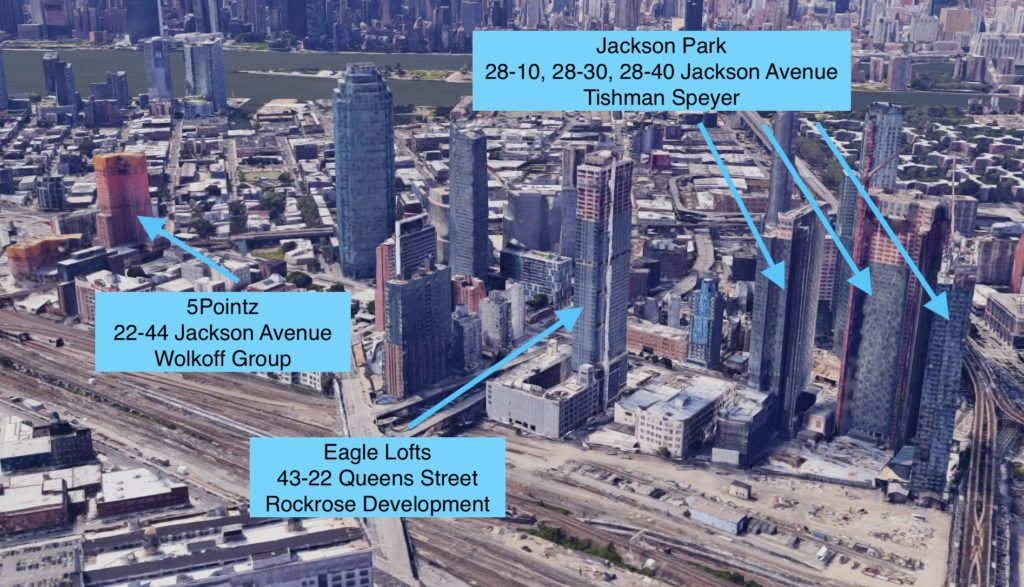

Tishman Speyer and Rockrose are likely to obtain Long Island City take-out loans valued in aggregate at $1 billion or more this year (Photo: Google)

Developers have opened large rental towers in growing Queens market

By Adam Pincus

Tishman Speyer an